Arctic Wolf: An Employee Stock Options Case Study

Questions you are probably asking yourself if you have stock options from Arctic Wolf: “What the heck are these? What do I do with them? Do they have value?”

Today, I am going to break these questions down for you and give you a couple examples to help you understand what your stock options offer you.

What the Heck Are Arctic Wolf Stock Options?

In layman’s terms, stock options give you the right to purchase company stock. A super important tidbit to remember is that just because you have stock options does not mean you own the stock! You must exercise your right to purchase the stock through the options you were granted.

I emphasize the word right because there is no requirement on your behalf to do anything with the stock options offered. Inaction on your stock options may be a realistic option to consider depending on your situation. However, the risk of not doing anything could leave you wanting to slam your head against a wall later in life. Could you imagine getting stock options at a price of $1.15 but never doing anything with them? Then a few years down the line watching the stock price grow to $25? OUCH!!

Let me pause for a moment and go over some key terms that will help guide us as we dive deeper.

Key Stock Option Terms

Grant

The stock option offer the company is giving you that contains key details about the stock options.

A grant may read something like this, “Arctic Wolf hereby grants the employee 10,000 Incentive Stock Options (ISOs) that vest equally over a 5-year period with the first vest date occurring 12 months after the date of this grant.”

Vesting

This specifies when the stock options become yours. Grants offer anywhere from monthly vesting to annual vesting.

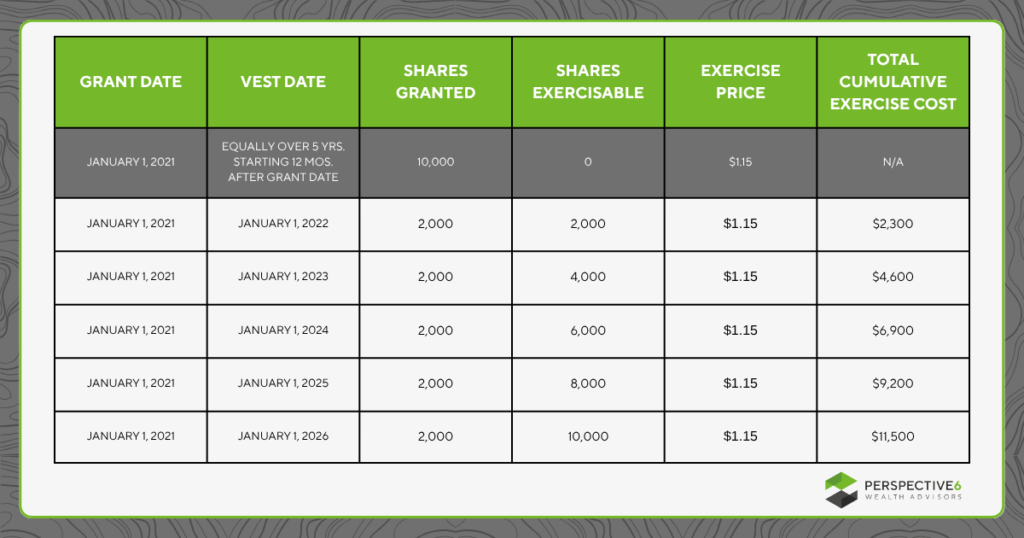

Using the grant hypothetical example above of 10,000 Incentive Stock Options (ISOs) that vest equally over a 5-year period with the first vest date occurring 12 months after the date of this grant – the vesting schedule will look like this:

- 12 months after grant: 2,000 stock options become yours

- 24 months after grant: 2,000 more stock options become yours (total stock options obtained = 4,000)

- 36 months after grant: 2,000 more stock options become yours (total stock options obtained = 6,000)

- 48 months after grant: 2,000 more stock options become yours (total stock options obtained= 8,000)

- 60 months after grant: 2,000 more stock options become yours (total stock options obtained = 10,000)

Exercise Price

The price you will purchase company stock at as listed in the grant.

Your grant details will specify the exercise price. As an example, it may say something like this, “These Incentive Stock Options have an exercise price of $1.15”.

Market Price

The price that the stock sells at in public or private markets. Think of this as the real value of the stock and it will fluctuate.

With a private company like Arctic Wolf this can be more difficult to determine. It’s not like a public stock like Google where you can do a quick search and see the stock price in seconds. More on private stock prices later.

Sale Price

The price that you sell the stock you own for. This comes after exercising your stock options and waiting for them to vest.

Again, selling private stock is much harder than selling public stock but that doesn’t mean it is a bad investment.

What Do I Do with My Arctic Wolf Stock Options?

Now that we have got some basic terminology out of the way let’s answer the question of what to do with your stock options. There are a variety of factors to consider when deciding how to move forward. Common factors I discuss with clients are liquidity needs, risk, taxes, and impact of other goals.

For our purposes today let’s make a couple of hypothetical assumptions:

- You have an adequate emergency fund set aside and have cash to make a new investment.

- You have no significant impending financial goals besides retirement

With those two things in place, you can dig into exercising your stock options.

Understanding the Risk of Stock Options

Next up is the importance of understanding the risk of stock options. The largest risk is that you exercise your stock options hoping the stock price goes up, but it never pans out and you lose your investment. The cash spent to exercise the options is not typically backed by any protection agency. Therefore, if you exercise $10,000 worth of stock options, you have to be okay with the possibility of losing all that money. That is obviously the worst-case scenario.

The possibility of the stock price increasing and providing a significant boost to your net worth is also there. Stock options could propel you towards other goals that you may never have thought were possible.

Let’s use the chart below to help illustrate how exercising your stock options works.

Okay, you were granted 10,000 stock options that vest over 5 years equally with a starting vest date 12 months after your grant date. The exercise price is $1.15 per option. So, just looking at this chart and zoning in on the January 1, 2022 vest date, you may think to yourself, “$2,300 is a lot of money to fork over right now.”

Do I Need to Exercise All the Shares Available?

This is a common question I see from clients. However, it is super important to remember not all the shares need to be exercised at once! The company is giving you the option to exercise 2,000 shares total. Although, you are typically allowed to exercise any number of shares as long as it does not exceed the amount in the “shares exercisable” column.

Perhaps $2,300 is too costly for your personal situation because you have an AC unit that needs repair, a vacation coming up, or otherwise. You decided you can only afford to exercise $500 worth of stock options at this time. That is perfectly fine! Using that $500 you would still end up with close to 435 shares of stock owned after exercise! That’s one of the best perks to stock options in my opinion. It allows you to pick when and how many of the shares you wish to exercise, it’s not an all or nothing type of deal.

Just remember to pay attention to expiration dates because stock options can expire! The expiration date will typically be found in your grant letter. Most of the stock options I see from Arctic Wolf have a 10-year expiration date.

Do My Arctic Wolf Stock Options Have Value?

Continuing with this example, let’s explore the value of stock options. When a private company issues stock options they must go through a valuation process. During that valuation process the company’s financials are reviewed by a third party.

Once valuation is complete the third party assigns a value to the business as a whole. A quick online search will show you that Arctic Wolf’s current valuation is in the $3.8-$4.4 billion range. Through this same valuation process a stock price is assigned to the company’s outstanding shares.

Most of the time a private company will use the stock price from their most recent valuation as the exercise price on their next round of stock option grants to their employees. Looking back at the chart from earlier, the price of $1.15 per share are from Arctic Wolf’s valuation in 2021 (at the time of the grant).

So, what does that mean for you?

Well, let’s just assume you exercised 2,000 stock options when the first vest date came around in 2022. In theory you now own $2,300 worth of private stock. Some people will view this as fake money but in the real world it is an actual asset you now own. Though it will fluctuate year to year based on what is happening with the company and other economic factors.

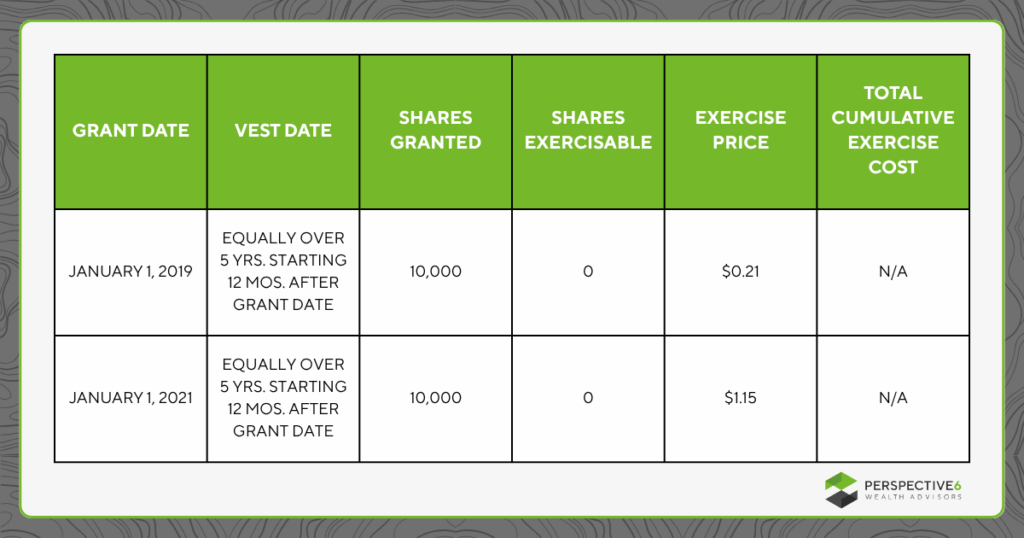

If you have multiple grants of stock options over a course of multiple years, pay attention to the exercise price. If it’s increasing, then that means the company’s valuation is increasing and the value of your stock options is getting larger. Which is a great thing!

Look at this for a second and see if you spot anything interesting:

Do you see it? If not, let me help. Look at the grant dates, they are two years apart. Now look at the exercise price… that’s a 5.5x increase in just a two-year time span! Imagine if you exercised all your available stock options that were granted in 2019. Heck let me just show you what that could look like!

- Due to the vesting schedule, you would only have 4,000 stock options exercisable by the time the 2021 grant came around so let’s say you exercised all 4,000 stock options at that time. That would cost you about $840.

- But based on the new grant you got in 2021, the actual stock price is $1.15 per share, meaning your 4,000 shares that you exercised earlier are potentially worth $4,600 now. That’s a 447% return on your money – not too shabby!

Private Stock vs. Public Stock

That return is only good if you can lock it in! Which just happens to be the most difficult part of owning private stock; it is not as easy to sell as public stock. There are buyers in the private markets but fewer.

Not to mention that the cost sometimes associated with that will eat away at your gains more than it is worth. That’s why accepting the risk to stock options on the front end is important. You may not be able to realize any value from exercising your stock options and owning the shares until the company has an event such as an IPO.

For those of you who made it to the end of this, I hope it helped you understand your stock options and what they are all about. Remember, the stock options that are granted to you are a real asset with real value! They also come with risk.

As stated earlier, there are several factors you need to consider before throwing all your cash into private stock options.

That being said, in the right situation these options can be a powerful wealth creating tool.

If you work at Arctic Wolf and need help evaluating your specific stock options, please reach out to us.