Market Outlook 2026: Making Calculated Risks

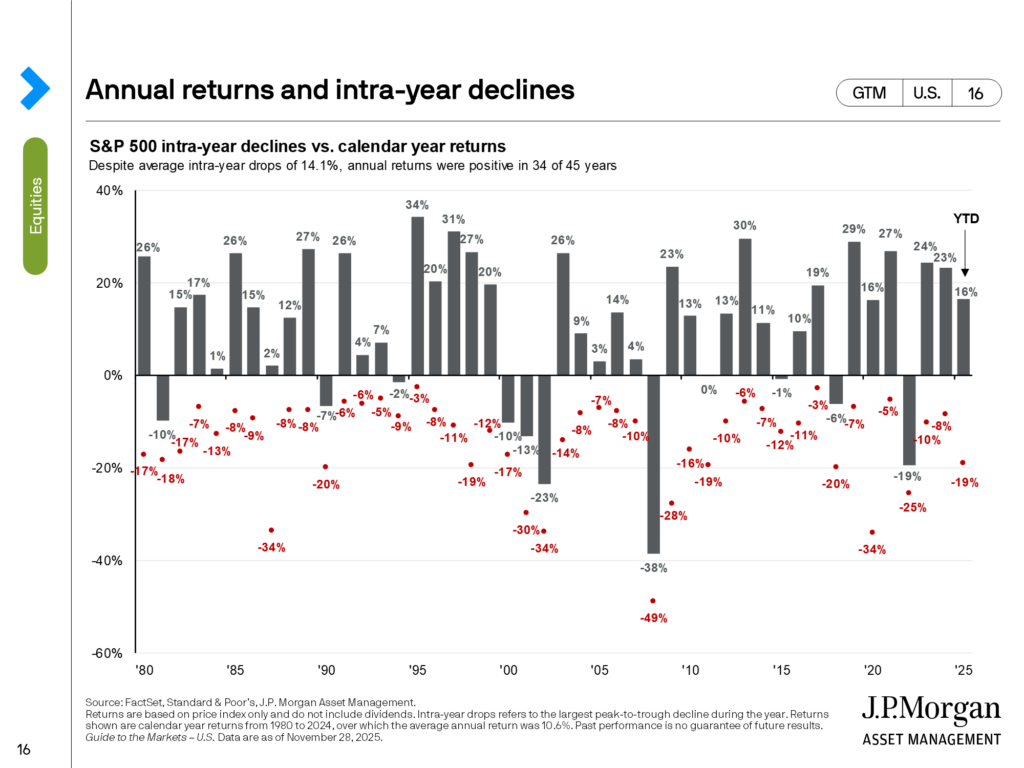

Wow, what a rollercoaster 2025 has been. The year began with the changing of Presidents, which then flowed into policy shocks with the rollout of tariffs. These policies helped drive the S&P 500 down near 19% in March with a subsequent 7-month run higher. 2025 has seen the continuation and completion of wars, inflation shocks, cultural shifts, government shutdowns, and the passage of the OBBBA. It’s safe to say this year has been a wild ride.

A shocking statistic on the year is that there have been 37 new all-time highs in the S&P 500 (as of this writing). While that isn’t a record (over 70), it comes in the face of chaos and uncertainty. In our article this time last year, we saw a growing but volatile market ahead. It was our thought that markets would be higher this time of year and that the economy would expand regardless of policy, laws, or cultural shifts. Why were we correct in that estimate and what is the market outlook we see for 2026? Let’s take a brief look back and explore what may be ahead.

A Look Back at the 2025 Market

As 2024 ended, we anticipated a bullish environment with some risks in the economy. The largest risk being employment, inflation and political/policy risk and what a year it has been on all those fronts. Further, we indicated a moderate target of 8% S&P return with a general range of -4.8% to +16% with a high target of 6842. As of this writing, I am pleased to say the S&P is closer to the upper target with a return of about 15% and 6755 price. While that may come as a surprise, the overall economics and company earnings drove us to these levels.

Market Outlook for 2026

Much like a year ago, our outlook has us anticipating a potential market pullback early in 2026. The fall in the markets in March and April of 2025 was severe, down 19% at one point. It is not abnormal to have 10-15% pullbacks in a calendar year even when we remain overall bullish. We could see a repeat of last Spring this coming year. However, it does not currently appear that it will be as severe.

What Do We Anticipate Moving Forward in 2026?

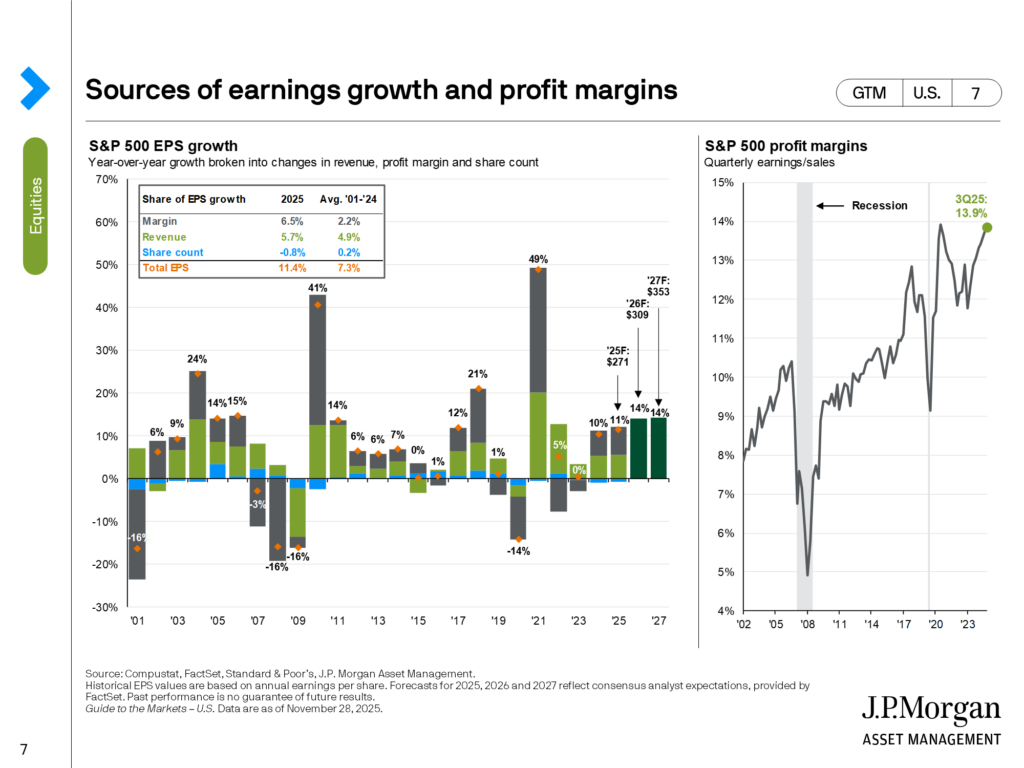

As investors, we like to focus on the larger data and broad actions that cause economies to move up or down. When we invest in stock markets, we invest in the growth of companies. Therefore, the basis of our economic modeling is rooted in earnings per share of those companies and our expectations looking forward for those earnings. In 2025, we saw earnings per share (EPS) in a range of $11 for 2025 and $17 for 2026. Now in 2026, that same window is approximately $14 for 2026 and $14 for 2027. If we use similar estimates as last year, then we would be looking at a range of -7 % to +13% for the year.

With earnings expected to be similar for 2026 and 2027, that is a ‘flat’ projection versus growth. This leans us toward an average end of 2026 year target of 7-8% in the S&P 500. Now, couple that with an expected aggregate bond return in the 6-8% range for the year based on FOMC rate cut projections. We then have the makings of a very average but positive year in the overall markets and our portfolios in general. If anything, I would hedge a little lower for 2026 but still on the positive side.

Positive Catalysts Ahead

- U.S. growth expected to accelerate in 2026, especially early in the year.

- Inflation will continue to trend lower with a small move higher early in the year expected.

- Employment appears as though it may be bottoming and could strengthen in 2026 overall.

- Federal reserve will continue with multiple rate cuts creating a tailwind for equities, bonds, and consumers.

- AI and Crypto adoption leading to new uses and new technologies – still in the earlier innings of the AI revolution.

Negative Catalysts Ahead

- Employment continues a long trend down since 2021, now sitting well over 30 months.

- Policy mistakes or road bumps – another congressional shutdown early in 2026 is currently likely.

- AI CAPEX spending collapses and investors run for the doors; AI bubble fear becomes reality. While we do not believe there is a ‘bubble’, the fear from investors could show up in sharp declines.

While global events and policy shifts can rattle the markets, economic trends provide longer term clarity and direction. It is prudent to continue taking measured risk as in 2025, without adding any additional risk at this time. While there will be market volatility, reducing risk in portfolios would be a mistake. This is because we are still in an economic expansion cycle, lowering inflation and interest rates, and hopefully an improving jobs market. 2026 may be the end of this bull cycle or it could be the middle innings of a longer expansion. Proper risk allocation allows us to take these measured risks while changing data influences our adjustments throughout the year(s).