What the One Big Beautiful Bill Means for Your Taxes

On July 4th President Trump signed into law the One Big Beautiful Bill. This marked a new era to our nation’s tax code. The bill covers a wide variety of items ranging from government spending to manufacturing to everyone’s favorite, tax law! As you know, changes to tax law always create a lot of discussion amongst the population. It also creates opportunities to revisit your tax strategy and navigate any new hurdles in the appropriate way. Today we will focus on what our team sees as the most relevant tax items in the One Big Beautiful Bill. Let’s dive in!

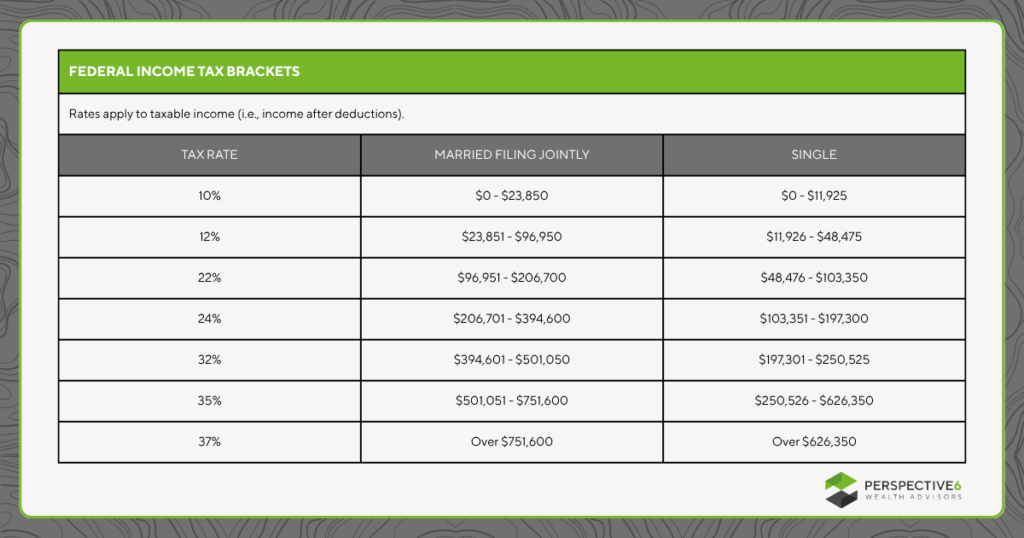

Federal Tax Brackets

Prior to the One Big Beautiful Bill, the current federal tax brackets were set to increase roughly 3% across the board in 2026. However, now these current tax brackets are “permanent”. I use quotations because tax law is almost never permanent. At the very least though we can expect these tax brackets to stick around for the foreseeable future.

Standard Deduction and Additional Deduction

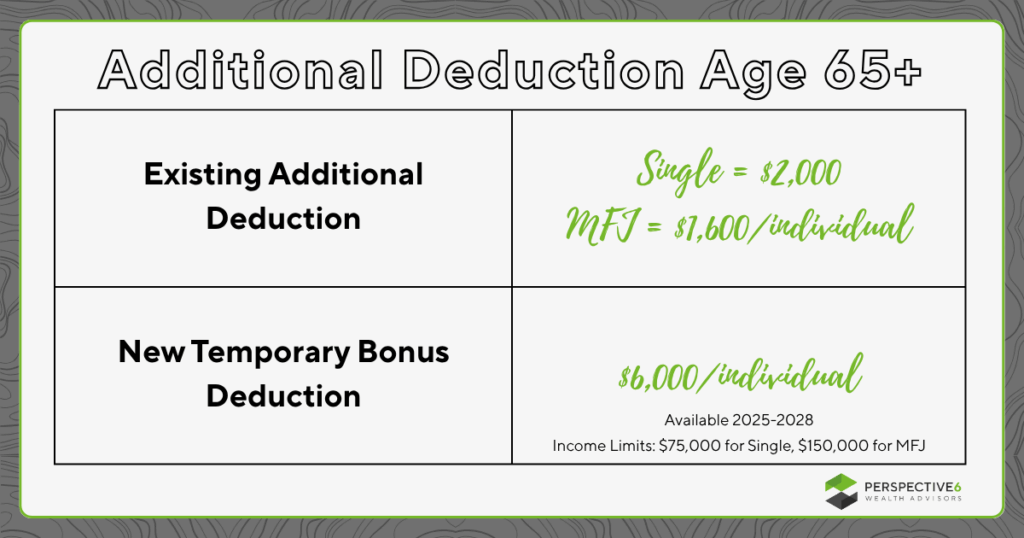

Much like the tax brackets, the standard deduction was also set to revert to historic levels. In general, this was going to cut the standard deduction by 50%. The cut would have increased most taxpayers’ taxable income and therefore their taxes paid. With the passing of the One Big Beautiful Bill, the standard deduction will increase from $15,000 to $15,750 (single) and $30,000 to $31,500 (married).

In addition to this, those 65 and older will now receive an extra $6,000 deduction if their income is lower than $75,000 (single) or $150,000 (married) as shown in the graphic below. However, as of now, this added benefit is only for tax years 2025-2028.

State and Local Tax Deduction (SALT)

The passing of the One Big Beautiful Bill will increase the SALT deduction limit from $10,000 to $40,000. A significant increase that will lower some taxpayers’ taxable income. The SALT deduction is a federal tax break that allows taxpayers who itemize their deductions to reduce their taxable income by the amount of their state and local taxes paid for the year. Taxpayers who utilize this tax break do not take the standard deduction. Further, for those earning more than $500,000 there is a phaseout to apply. Everyone has a guarantee of at least a $10,000 deduction though.

Qualified Business Income Deduction (QBI or Section 199A)

Small business owners may have been worried that the QBI deduction would be gone heading into 2026, but not so fast! The QBI deduction of 20% is now permanent through the One Big Beautiful Bill. Further, it expanded the income phase ins from $50,000 to $75,000 (single) and $100,000 to $150,000 (married). Basically the 20% QBI deduction is now available to more small business owners.

Estate Tax Exemption

The estate tax exemption was also set to reduce heading into 2026. A provision in the One Big Beautiful Bill made the current estate tax exemptions permanent. In 2026, each taxpayer will have an estate tax exemption of $15 million. This means a married couple will have a combined estate tax exemption of $30 million. Further, this is will index as an inflation number.

One Big Beautiful Bill Tax Wrap-Up

As mentioned before, the One Big Beautiful Bill covers a lot and from our perspective creates a lot of tax planning opportunities. The topics discussed above are just some of the bigger tax-specific ones we like to keep our eyes on. If you want help navigating the new tax laws or ensuring your financial plan is up to date, reach out to us today!